What distinguishes Steel and Milling from every other industry? Business processes are simply different. Whilst the sales and distribution are very much following a discrete manufacturing pattern, the production processes are closer to other process manufacturing industries. This makes it difficult for businesses in this industry to implement an end-to-end digital business process.

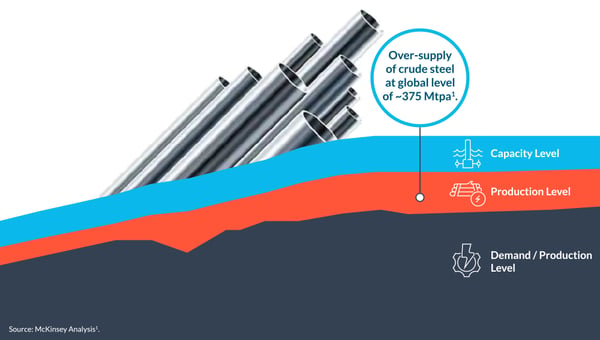

Does this mean that the promises of Industry 4.0 and digitalization are inaccessible for Steel and Milling? The opposite is the case! With stiff market conditions and a general over supply and protective tariffs across different regions companies cannot afford to not look into digitalization measures [1].

Solve your toughest sales challenges with a Digital Sales Platform built for manufacturing. Download our new guide, "Roadmap to Digital Go-to-Market Sucess" to find out how!

Figure 1: Over-supply in the Steel Industry - Digitalization is the key to stay competitive [1].

Next-Generation Operating Models for Steel and Milling

- Significantly reduce turnaround time via digital sales channels to lower entry barriers and excel in ease of consumption

- Standardize their offering and introduce end-to-end digital processes to compete on lead-times for order processing

- Tap into new up-market business application areas and businesses which require a higher agility in go-to-market and collaboration across different business departments

Figure 2: End-to-end customer journey as the central element of next-generation operating model [2]

Challenge: Technical Depth and Legacy Backend Implementations

Businesses in the Steel and Milling industry operate under very specific conditions:

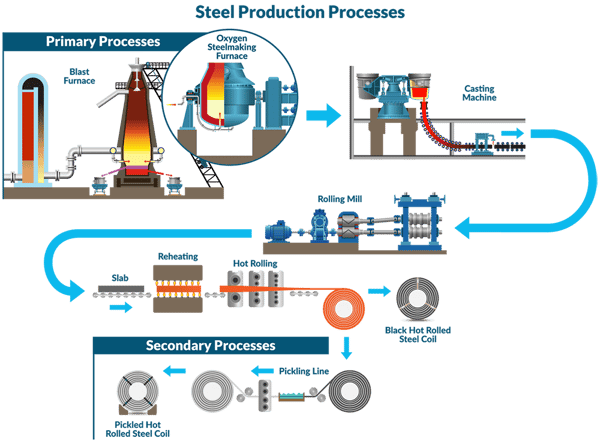

They have a well-defined product and manufacturing process but can be classified somewhere between discrete and process manufacturing. In the past decade, they spent a lot of effort optimizing backend processes and building partially custom IT solutions or ERP functions to support the production process. Following these investments, steel manufacturers are nowadays often leading in Industry 4.0 style backend automation.

For example, many companies in the steel industry have sophisticated IT solutions to compute a manufacturing program from customer requirements. These would consider all manufacturing processes, from steel quality, dimensions, quality control, and available semi-finished goods. Thus make-to-order or engineer-to-order backend processes, such as production planning, supply chain management, and costing are often highly accurate and sophisticated - but disconnected from the front office sales systems.

Figure 3: Primary and Secondary Steel Production Processes [3]

Figure 3: Primary and Secondary Steel Production Processes [3]

Adopting easy-to-consume digital tools such as sales portals (leaning towards e-commerce), Customer Relationship Management (CRM) or Configure Price Quote (CPQ) to implement an agile enterprise is a challenge. Technical depth and legacy implementations often make it expensive to move quickly into a digital B2B customer journey.

Case study: Agile Sales Transformation with SAP ERP Variant Configuration and In Mind Cloud's Digital Sales Platform

Depending on the backend system and customization, In Mind Cloud’s Digital Sales Platform offers different implementation techniques to quick start into a fully digitalized sales and go-to-market.

Many steel and milling companies implemented, for instance, an SAP ERP in the last two decades due to its sophisticated make-to-order capabilities in production planning and fulfillment.

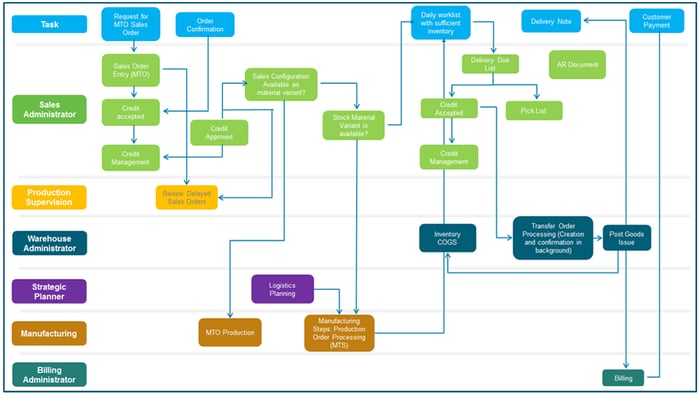

Figure 4: Make-to-Order Production with SAP Variant Configuration [4]

Figure 4: Make-to-Order Production with SAP Variant Configuration [4]

To fully cover requirements, custom extensions have often been built into the ERP variant configuration to support an end-to-end digital backend process. They are, in most cases, very complete from a manufacturing point of view. Nevertheless, they create obstacles for an agile go-to-market. On top of that, they are too complex to be used by sales or even customers and remain mainly in the back-office.

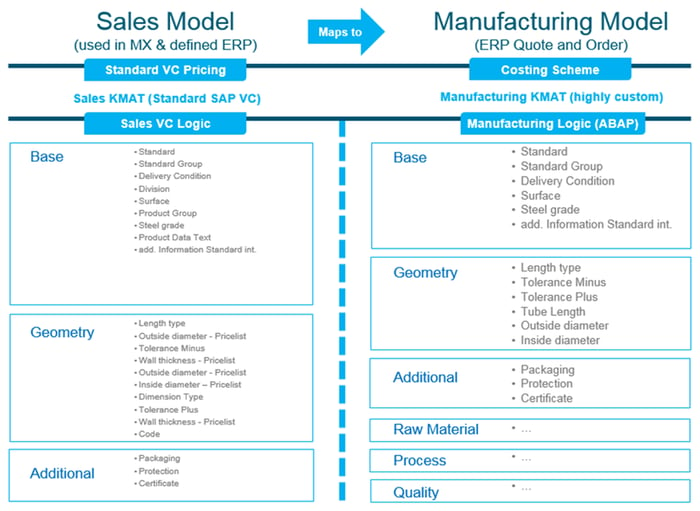

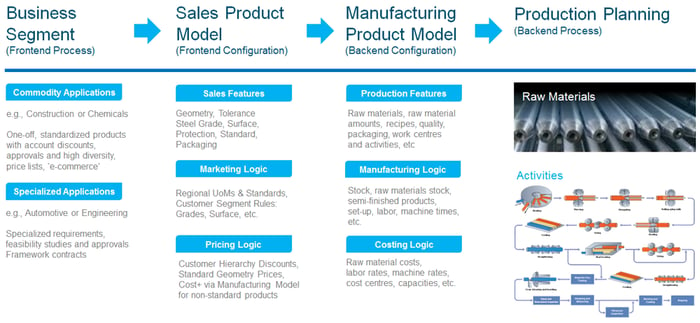

In Mind Cloud implemented one solution to this problem successfully with multiple customers: The goal was to generate or build simplified sales models that focus on customer requirements rather than manufacturing capabilities. They would omit all details that are irrelevant from a go-to-market and sales point of view. These simple sales models as well as the legacy manufacturing models may evolve independently and interact through our sales platform as middle layer. Thus, the system is empowering market agility and manufacturing completeness at the same time. We therewith circumvented the immediate need to revamp the legacy backend manufacturing models built in SAP Variant Configuration, but still guarantee 100% support for all sales requirements, paving an agile way into future 'next-generation operating models'.

Figure 5: Frontend and backend product model.

Figure 5: Frontend and backend product model.

From a sales and go-to-market point of view, one should also factor in the needs of different business segments, which require slightly different business processes in the front-end system. For instance, automotive customers will usually order very specialized products in high quantities, over long-running periods. In these scenarios, the interaction would be high-touch and direct. While in construction and engineering sectors, the customers will usually buy a high diversity of commoditized products in a one-off fashion. They will prefer more of an ‘e-commerce’ style purchasing experience, combined with low-touch sales support on the product portfolio.

If you are putting a sales platform like In Mind Cloud's in the centre of a sales solution landscape to feed all the relevant information from the backend to the frontend, you can fully support the different user journeys. It also empowers you to entirely leverage the backend complexities in existing frontend system such as E-Commerce and Marketing portals (SAP Hybris or Commerce Cloud, Adobe Magento, etc.) or CRM systems (SAP Sales Cloud / Cloud for Customer, Microsoft Dynamics or Salesforce) which are incomplete or even inaccurate without these capabilities.

Figure 6: End-to-end experience.

Figure 6: End-to-end experience.

Return on Investment of CRM, Commerce and CPQ Investments

Let’s capture the business case for a CRM and CPQ solution specialized for manufacturing industries and even cover an ‘e-commerce’ style purchasing experience. The salient points are usually a plus in effectiveness and efficiency for sales representatives. Whilst this is true, there are also multiple quantitative benefits of a sales solution – on both ends: bottom-line and top-line – which can easily be used to understand the return of investment (ROI) of manufacturing CPQ and CRM solutions.

Key bottom line benefits are:

Improved accuracy of the business forecast, which also helps to identify gaps in the sales pipeline. Properly managed, this can help to balance production capacities as well. For example, production lows can be avoided by offering additional incentives to a customer if he purchases at a time where the production capacity is not fully packed yet. In turn, optimization of the production capacity can lead to cost reductions due to higher utilization.

Reduction of cost of error, is another key benefit. Wrong business terms or orders for products that cannot be produced or do not fulfil the customer requirements may lead to non-collectable revenue. A sales solution can remove such cases entirely. Another effect of error reduction and increased turnaround times is a significantly reduced number of changes in orders. This, all together with a very accurate forecast can speed up lead times tremendously.

Figure 7: Bottom-line benefits.

Figure 7: Bottom-line benefits.

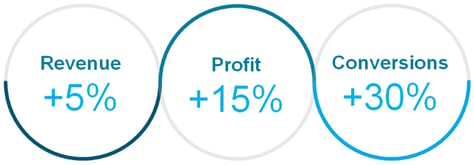

Top-line benefits: Improved lead-times are a competitive advantage. Similarly, quick quotation times, or even ‘e-commerce’ style frontend sales systems reduce barriers in the purchasing experience. Investing in improved customer experience can contribute to top-line growth of up to +5% in revenue, +15% in profit and +30% in conversion according to recent McKinsey reports [3].

Figure 8: Top-line benefits.

Relevant McKinsey Reports:

[1] The current capacity shake-up in steel and how the industry is adapting

[2] Turbocharging the next-generation operating model

[3] Finding the right digital balance in B2B customer experience

Do you want to learn how to build a sustainable strategy to respond to current and future manufacturing sales challenges? Download our Guide to "Accelerate Manufacturing Sales"!

Deutsch

Deutsch