Your business is part of an industry that is a significant economic global force. That's because besides comprising of manufacturers that design, develop, and manufacture cars, it also includes auto parts and components manufacturers. Your business is part of a massive chain that supplies the entire industry with components needed to create an automobile--of which 70 million are expected to be sold in 2021.

Regardless of what your business manufacturers--brakes, suspension, steering systems, engine parts, safety management, climate control equipment, engine cooling, and exhaust systems, and interior, cockpit modules, or even the humble screw--it can be subject to the same push and pull of the global economy.

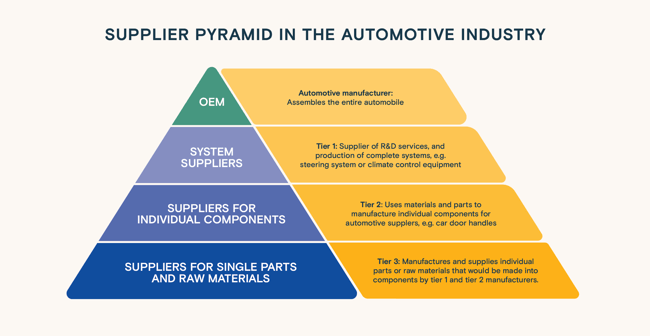

However, depending on your position in the automotive industry pyramid, the business impact of market movements can be felt more acutely in some areas, and less in other areas.

The supplier pyramid in the automotive industry comprises 3 key tiers

The supplier pyramid in the automotive industry comprises 3 key tiers

The supplier pyramid is classified in tiers 1-3 according to a hierarchical order (tier 1 supplies directly to the manufacturer). Most suppliers in the automotive industry are already facing massive price pressure through global competition and volatile material costs. At the same time, due to increasing customer expectations, the entire industry is also transforming at lightning speed, resulting in shorter innovation cycles.

New and existing challenges can strain your manufacturing sales to its breaking point--unless you strike first with a digitalization strategy that works for your business. However, to understand how to transform your existing sales processes, you would first need to understand how it works. Here's a brief look at the models that the automotive industry manufacturers use to meet demand, its weaknesses, risk, and opportunities.

5+1 types of manufacturing that define sales in the automotive sector

Manufacturers in this sector employ sales strategies that help them navigate market conditions. However, their strategies can also be influenced by their business model. Here is a brief description of the various business models they use to meet market demand.

Make-to-stock (MTS) in automotive

Why this model is used

- Demand for products is predictable and easily forecasted

How it works for automotive manufacturers

- Expends capital to produce goods in advance

- Capital is bound to the finished goods until they are sold

- Incoming orders use existing inventory, keeping lead times low

Ideal for manufacturing products that:

- Are mass-produced at low costs and high quantities

- Are readily available with extremely low lead times

- Requires little to no engineering and design

Make-to-order (MTO) in automotive

Why this model is used

- Standard products and specifications are clearly defined

How it works for automotive manufacturers

- Products are only produced when orders are received

- Lowers risks of overproduction for manufacturer

- Increased production costs and lead times

Ideal for manufacturing products that:

- Cost more, but can be produced in large quantities upon order

- Requires some engineering and design

- Can be manufactured and delivered fairly quickly

Why this model is used

- A flexible model that allows for speed and reduced waste

How it works for automotive manufacturers

- Parts and components are pre-produced

- Assembly only happens when orders are received

- The manufacturer is ready to fulfill orders instantly

Ideal for manufacturing products that:

- Are ordered in lower quantities

- Requires some engineering and design

- Do not offer options to configure

Configure-to-order (CTO) in automotive

Why this model is used

Enables mass customization and faster response timeHow it works for automotive manufacturers

- Products configured and assembled according to requirements

- Standard subassemblies made-to-stock and instantly available

- Final assembly is postponed until the order comes in

Ideal for manufacturing products that:

- Are ordered in lower quantities

- Offer a large number of configuration options

- Requires moderate engineering and design

Engineer-to-order (ETO) in automotive

Why this model is used

- Extremely complex or specialized product or solution

How it works for automotive manufacturers

- Project-based work starts only when order is received

- Comprises a long timeline of design, engineering, and production

- Final product is engineered according to unique specifications

Ideal for manufacturing products that:

- Are ordered in low quantities

- Requires a high degree of engineering and design

- Has highly specific customer requirements

Manufacturing-as-a-Service (MaaS) in automotive

Why this model is used

- Highly optimized by emerging Industry 4.0 technology

- Fast, low-cost, high-quality production of almost any product

- Resource consumption can be kept under tight control

How it works for automotive manufacturers

- The manufacturer is equipped to produce anything a customer wants

- Uses shared infrastructure to reduce costs and improve quality

- Process expertise instead of products is sold to the customer

Ideal for manufacturing products that:

- Are highly innovative and new to the market

- Requires high customization or personalization

- Needs to be low cost even in low quantities

- Has fast time-to-market requirements

Different manufacturing complexities in the automotive industry

The automotive industry is undergoing several changes. The impact of global demand and low-cost competitors can be felt by automotive manufacturers, down to the tier three suppliers. The need to press on amidst uncertainties has never been stronger.

From specialized suppliers of various technologies to their OEM customers, innovation and speed are of the utmost importance. Tried and true business models like MTS or CTO are already giving way to hybrid models that let automotive manufacturers and their suppliers have the edge when meeting customer demand.

Industry 4.0 technologies let suppliers react to on-the-fly enhancements by their OEM customers, giving them the agility needed to innovate and delight car buyers around the world. But with this speed and agility, comes the need for new sales strategies that also consider traditional functions like supply chain, stock management, production, design, engineering costs, and quality control.

The amount of data needed for these highly complex strategies, however, far exceeds what legacy systems are equipped to manage. Forward-thinking manufacturers are now turning to Industry 4.0 era systems to help manage their data and the complexity that comes with the rising number of business functions and sales strategies.

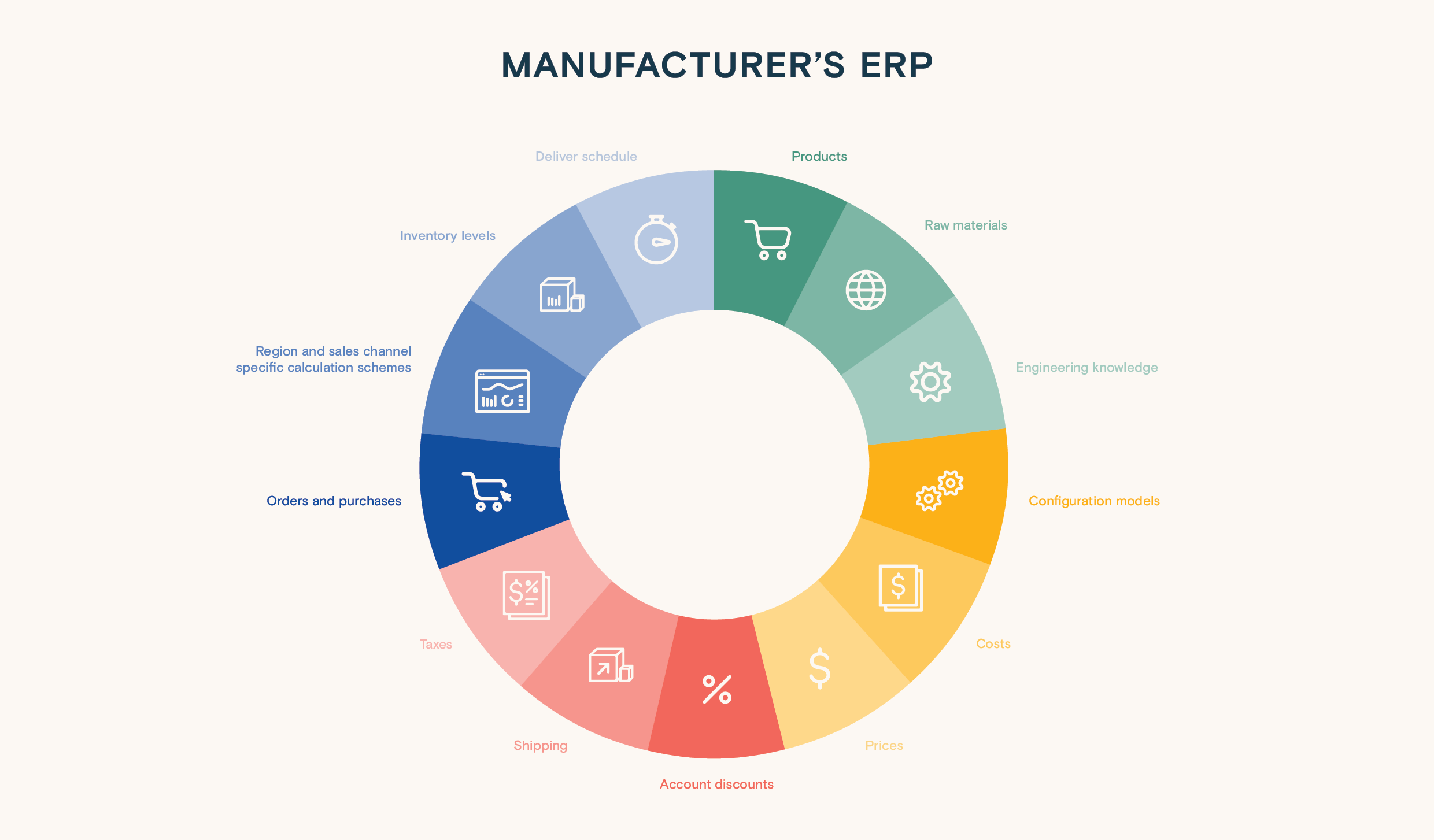

These are challenges that a powerful digital sales platform can overcome through seamless integration with a manufacturer’s ERP, and existing IT systems sales depend on (e.g. Salesforce CRM). Ultimately, it is a strategic choice that leading manufacturers make to meet the demands of the market today, and take advantage of future opportunities.

A leading digital sales platform is also built to support all the manufacturing models your business uses. The key element that makes it so powerful is its ability to align your customers' goals with your manufacturing capabilities via seamless integration with your ERP.

Valuable sales data Electrical Equipment manufacturers need to extract from their ERP

It uses critical sales-relevant data, and shares it across the entire sales process:

- Complex configuration & pricing calculations

- Customer management & accurate forecasting

- Online sales and channel management

Regardless of the manufacturing model your automotive manufacturing businesses uses, each sales function accesses the same data in real-time. For example, the online configuration of an engine by your B2B customers, uses the same prices, or product data that your partners or dealers use. The system is also powerful enough to ensure the data is individual-specific--meaning each party only sees data (like prices and discounts) that you want them to see.

With a powerful digital sales solution like the In Mind Cloud Digital Sales Platform, your automotive manufacturing business can perform better. Your goal can be to reduce costs, increase revenue, improve efficiency or simply to prepare your business with a competitive advantage--and our Digital Sales Platform is built to get you there.

To understand more about how digital sales can help improve your manufacturing business, download our Manufacturing Sales Handbook here.

Part of this blog post appeared in an article that was first published on the G2 blog

Deutsch

Deutsch